Disclaimer: We are not financial advisors. This article is based on personal experience and public sources. Always do your own research before making investment decisions.

We have debated for a long time before writing this article. This is because there’s risk involved. But here’s the thing: if there’s one strategy that can seriously boost your financial freedom over the long term, it’s investing your income in ETFs. Since we follow this method thoroughly, it’s only fair we write about it. After all we’re trying to be as transparent as possible. It’s important to do your research regarding this topic as investing always implies risk. A nice place to start is r/bogleheads.

Why do we think investing side hustle income in ETFs is worth it? Because ETFs offer low-cost, diversified, long-term exposure to the growth of global economies. Add in the power of compound interest and the patience to stick around for 20-30 years, and you’ve got the perfect recipe for wealth generation.

Let’s break it down specifically for European investors who want to start investing side hustle income without relying on USD-denominated products or expensive financial advisors.

What is an ETF?

An ETF (Exchange-Traded Fund) is like a basket of shares you can buy with a single purchase. Instead of picking individual stocks, you invest in dozens or even thousands of companies at once, instantly diversifying your portfolio.

There are thousands of ETFs, each with its own focus: global equities, specific regions (like the U.S. or Europe), dividend-paying companies, sustainable energy, tech, and more.

Most ETFs passively follow an index like the AEX or S&P 500, which keeps fees low and the structure transparent. That’s why they’re especially popular among beginner investors. Just keep in mind: even with broad diversification, ETFs can still lose value: all investing carries some level of risk.

Why Try Investing Side Hustle Income

You’re already putting in the hours. You’re making money on the side. Don’t let that money just disappear into Uber Eats and impulse amazon.com orders. If you’re serious about changing your future, investing part of your side hustle income is key.

Let’s say you earn €800/month from freelancing. Investing even 25% monthly (€200) at 7% annual return:

- After 5 years: ~€14,000

- After 10 years: ~€35,000

- After 20 years: ~€100,000+

And that’s without increasing your contribution.

The Power of Compound Interest

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” – Albert Einstein (allegedly).

Compound interest means you earn returns not just on your initial investment, but also on the returns you’ve already earned. It’s interest on interest.

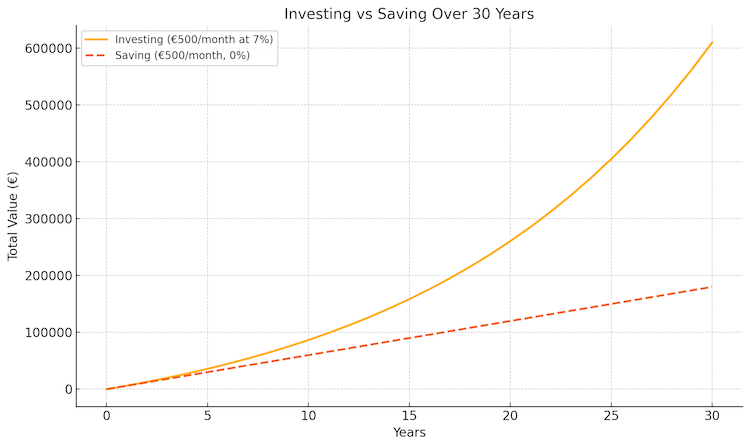

Let’s say you invest €500/month for 30 years with an average annual return of 7%:

- Total invested: €180,000

- Total value: Over €566,000

Compared to just saving €500/month in a bank account (earning nearly 0%):

- You end with just your €180k.

A visual to clarify the difference between investing and saving:

Monthly Investing vs. Lump Sum: Why Timing Matters Less Than Consistency

A lot of people wait to invest until they’ve saved a big chunk of money. But waiting is the real risk. Monthly investing, also called dollar-cost averaging (or “euro-cost averaging” for us), reduces your exposure to market timing risk.

Example:

- You invest €10,000 all at once.

- Or you invest €500/month for 20 months.

Which is better? It depends. But historically, regular investing tends to smooth out market volatility. You buy when prices are high and when they’re low, reducing your average cost per share. If you invest your €10,000 exactly when the market is high, you have a problem. Timing the market is very difficult, if not nearly impossible.

Over time, monthly investing has shown to be more stable and psychologically easier to stick with.

Choosing the Right Broker: Why We Use DEGIRO (Europe-Friendly)

We personally use DEGIRO, and here’s why:

- Low transaction fees

- Access to hundreds of global ETFs

- Core Selection: a list of ETFs you can buy monthly with reduced transaction fees if you follow the rules.

Example ETFs from the Core Selection:

- VWRL: Total world stocks

- VUSA: S&P 500

Opening an account is straightforward and you can start with small amounts, even €50/month. Plus: DEGIRO is regulated within the EU, making it ideal for European investors.

Four Long-Term ETF Strategies Based on Portfolio Complexity

Again: alway do your own research, we have four suggested strategies based on personal experience and research to help you on your way. DO NOT just copy it blindly.

Strategy 1: One ETF Portfolio: “Keep It Super Simple”

- ETF: Vanguard FTSE All-World UCITS ETF (VWRL)

- Who it’s for: Beginners, people who don’t want to research or rebalance, and those with very limited time.

- Why it works: VWRL includes over 3,000 stocks globally across developed and emerging markets. One fund, global coverage, decent diversification.

- Time horizon: 20–30 years.

- Risk profile: Medium: tied to global economic growth.

- Goal: Long-term financial freedom with minimal time commitment.

Strategy 2: Two ETF Portfolio: “Balanced Global Split”

- ETFs: VUSA (S&P 500) + IEMA (iShares MSCI EM Asia)

- Who it’s for: Investors who want higher U.S. exposure but still believe in emerging markets.

- Why it works: You get the strength and track record of the U.S. economy combined with the growth potential of Asia.

- Time horizon: 15–25 years.

- Risk profile: Slightly higher: more focused, higher volatility.

- Goal: Higher capital appreciation through targeted exposure to economic growth regions.

Strategy 3: Four ETF Portfolio: “Global, Dividend, and Defensive”

- ETFs:

- VWRL (Global)

- VHYL (High Dividend Yield)

- CSPX (S&P 500 accumulating version)

- AGGH (Global Aggregate Bonds)

- Who it’s for: Intermediate investors who want balance between growth, income, and safety.

- Why it works: It adds dividend income, exposure to bonds for downside protection, and both distributing and accumulating funds.

- Time horizon: 10–20 years.

- Risk profile: Balanced.

- Goal: Build a resilient portfolio that can support part-time work or early retirement.

Strategy 4: Eight ETF Portfolio: “The Full Buffet”

- ETFs:

- VUSA (S&P 500)

- IUSN (Developed World Small Cap)

- EMIM (Emerging Markets)

- ISF (UK market)

- XDWD (World ESG)

- IQQH (Global Healthcare)

- 2B76 (Automation & Robotics)

- AGGH (Global Bonds)

- Who it’s for: Advanced DIY investors who want maximum diversification, sector rotation, and resilience.

- Why it works: This portfolio covers regions, sizes (small/large cap), sectors (health, tech), ESG principles, and adds a defensive bond layer.

- Time horizon: 20+ years.

- Risk profile: Medium-High, but very well diversified.

- Goal: Maximise diversification and long-term growth while experimenting with new themes.

Step-by-Step: How to Start Investing Side Hustle Income

- Open a DEGIRO account

- Set up a separate bank account just for investing side hustle income

- Decide on your investment amount (e.g. 20-30% of monthly income)

- Choose your ETF strategy (1, 2, 4 or 8 ETFs)

- Set up monthly automatic transfers

- Track your performance every 6 months

- Stay consistent: ignore market noise

Final Thoughts

This isn’t a get-rich-quick scheme. But it is a get-rich-eventually strategy. If you invest consistently and let your money grow, you’ll be surprised at how much wealth investing side hustle income can generate over the years.

The best part? You’re no longer trading time for money. Your money works with you, even while you sleep.

If you’re ready to take control of your financial future, ETFs might just be the smartest move you’ll ever make.

For more transparent data, visit our Insights page where we share our real numbers, side hustle tests, and honest results.

Let’s build that freedom, one smart investment at a time. If you have any questions regarding investing side hustle income or need help choosing a strategy. Please reach out to us via email: www.100kpathway.com/contact. We are more than happy to answer your questions.